I'm in the insurance industry. I've worked as a claims adjuster for years as well as an underwriter and many other roles.

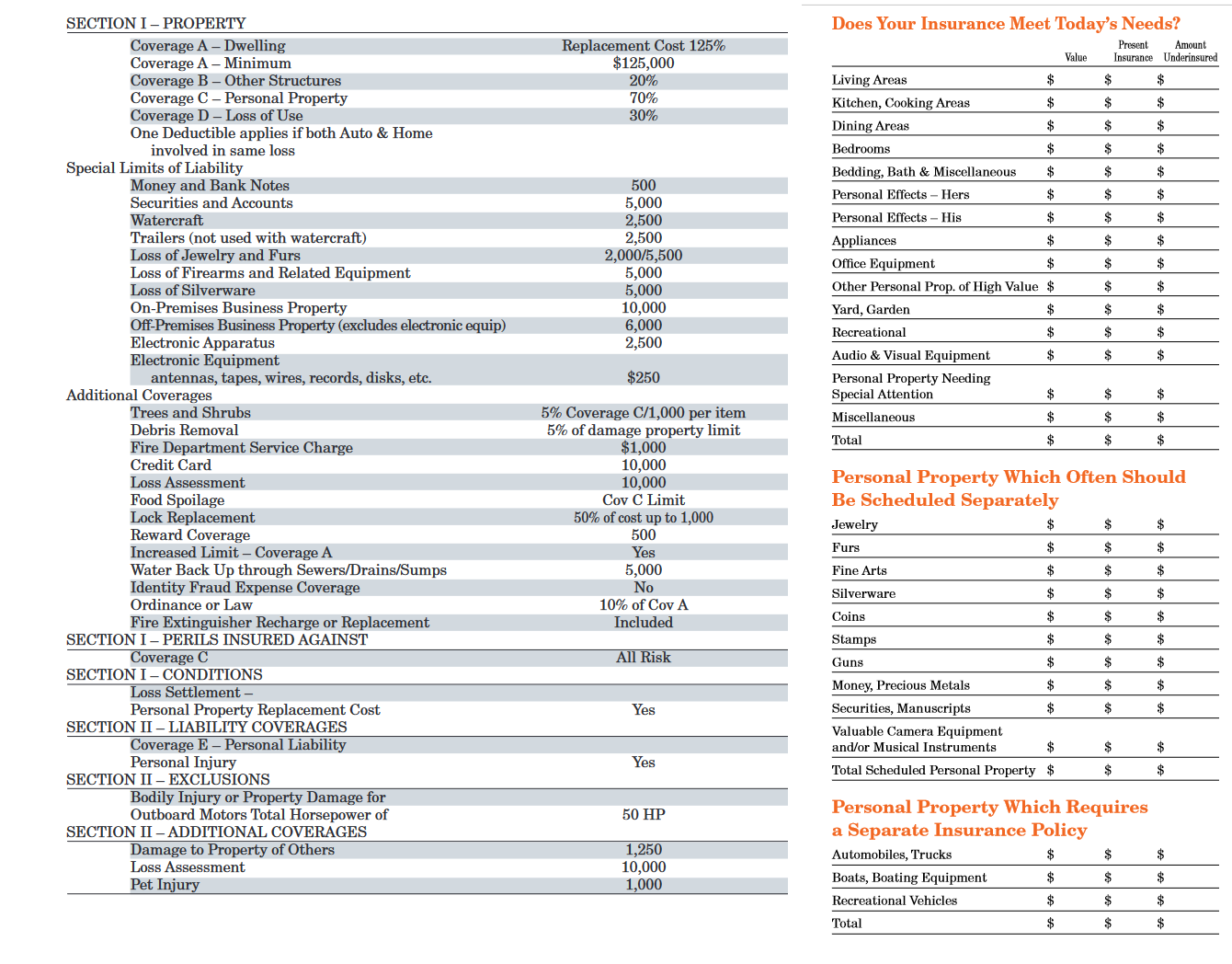

Get advice from your insurance broker/agent. Here is an excerpt of one insurance wording (and yes, one has to consult their insurance wording - it is the contract). The first section speaks to a $5,000 coverage limitation, the second section speaks to Actual Cash Value (not Replacement Cost)

'

$ 5,000 in all for collectibles, such as sports cards, sports memorabilia and comic books.

Property Subject to Actual Cash Value Settlements:

We will only pay the Actual Cash Value for loss or damage to these nine types of property:

1) a belonging that is not in good, useable condition at the time of loss.

2) a belonging not in current use by you at the time of loss that you stored away and for which you had no specific future use.

3) a belonging of an age or condition that makes it out of date or no longer usable for its original purpose.

4) art works, antiques, rare objects, and other items that cannot be replaced. *****

'

Based on the above there are two items to address:

1: are trains 'collectibles'? Based on the above wording/definition I suggest they are not.

2. ***** are they antiques, rare objects and other items that cannot be replaced? Perhaps?? and if so, they are subject to Actual Cash Value. Are they - 'art works'? Maybe! 🤣

Generally, if you can replace your train items new for old, with ones of like kind/quality, the insurer will provide Replacement Cost coverage subject to the insurance policy wording.

While my train collection isn't vast, I do have some nice pieces. Based on my home insurance wording, I do not have specific coverage for my trains. In the event of a loss I'll look to my home insurance policy to look after me.

If anyone has had poor insurance claims experience it is regrettable. Insurers look for ways to pay claims, not deny them. If they denied all claims and consistently provided lousy service no one would buy their product.

From this insurance 'nerd'. Great discussion!

-Richard